Table of Contents

1. Introduction to Form 10IEA

Form 10IEA allows taxpayers to opt out of the new tax regime and revert to the old tax regime. This form is crucial for those seeking tax benefits available under the old regime.

2. Eligibility for Filing Form 10IEA

Individuals and Hindu Undivided Families (HUFs) having income from business or profession need to file Form 10IEA to opt in for the old tax regime. Salaried individuals can opt in the new/old tax regime in ITR itself.

3. Submission Deadlines

The deadlines for submission of Form 10IEA vary based on the type of taxpayer:

| Taxpayer Type | Deadline |

|---|---|

| Non-Auditable Businesses | 31 July 2024 |

| Businesses Subject to Tax Audit | 31 October 2024 |

| Under Section 92E Audit Requirements | 30 November 2024 |

4. Required Information

To file Form 10IEA, you need the following details:

| Information Required | Description |

|---|---|

| PAN | Permanent Account Number |

| Assessment Year | Year for which the form is being filed |

| Taxpayer Status | Individual or HUF |

| Additional Details | Relevant information as applicable |

5. Step-by-Step Filing Process

Log in to the e-Filing Portal: Access the Income tax portal and log in with your user ID and password.

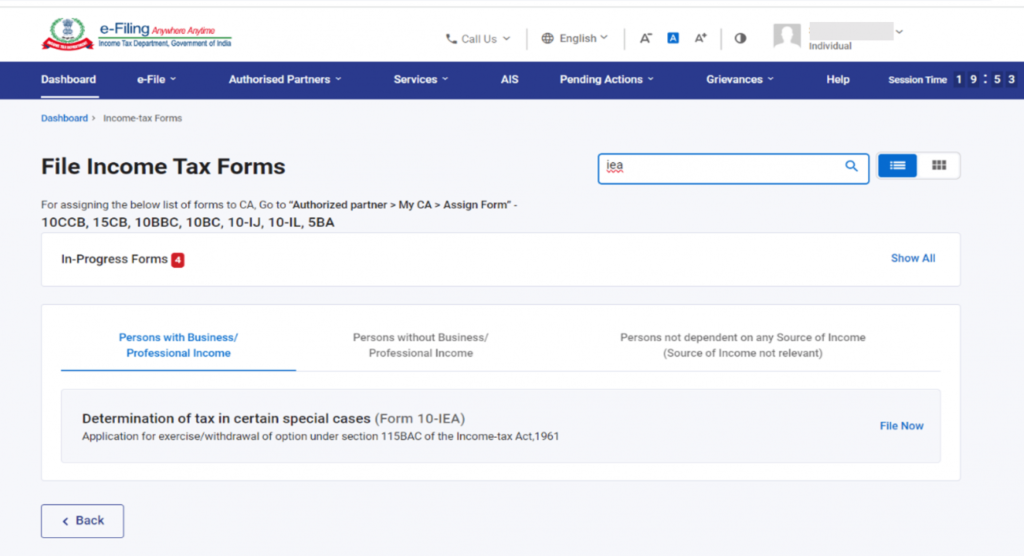

Navigate to Form 10IEA: Go to the e-File menu–> Income Tax Forms —> File Income Tax Forms and select Form 10IEA.

Fill in the Details: Complete the form with necessary information including basic details, additional information, and declaration.

Verification and Submission: Verify the information entered and submit the form.

6. Frequently Asked Questions

Q1. Who should file Form 10IEA?

Any individual or HUF engaged in business or profession and opting for the old tax regime (Claim deduction/exemption in ITR).

Q2. Can I switch back to the new tax regime after filing Form 10IEA?

No, once you opt for the old tax regime, you cannot revert to the new one for the same assessment year.

Q3. What happens if I miss the deadline?

Failure to submit Form 10IEA by the deadline will result in the default application of the new tax regime in ITR.

Q4. What if form 10IEA is filed, but taxpayer do not want to avail old tax regime ?

Once form 10IEA is filed then new tax regime is compulsorily required to opt in in the ITR.

Q5. For the assessment year 2024-25, if a taxpayer files Form 10IEA by mistake, can they revoke or withdraw it?

Once Form 10IEA is filed for the assessment year 2024-25, it cannot be revoked or withdrawn in the same year. The taxpayer must adhere to the old tax regime for AY 2024-25. However, the option to withdraw will be available in the subsequent year, and it can be changed only once in a lifetime for those filing under Business and Profession categories (i.e., in case of ITR-3 or ITR-4).

- Section 194T is a newly introduced provision in the Income Tax Act, 1961, mandating partnership firms to deduct Tax Deducted at Source (TDS) on specific payments made to their partners.

- Budget 2024 -Tax Reforms: Key Announcements

- Rajasthan

- Detail Explanation of form 10IEA

- Allowances and Deductions for Salaried Individuals in India for AY 2024-25